We offer comprehensive entity management services designed to support businesses globally, with a special emphasis on the Netherlands. Whether you are operating within the EU or beyond, our expert team provides tailored solutions to ensure compliance and efficiency in your entity's operations.

The 30% Ruling is a significant tax advantage offered to skilled professionals relocating to the Netherlands. This tax break allows expatriates to benefit from substantial tax savings, making the Netherlands an attractive destination for global talent.

Our services streamline the application process, ensuring you receive all eligible benefits and navigate Dutch tax regulations efficiently. We ensure that your business adheres to local regulations and international best practices, providing peace of mind and allowing you to focus on your core operations.

The 30% Ruling, sometimes referred to as the "expat ruling" or "30% reimbursement ruling," is a tax benefit provided by the Dutch government for highly skilled international employees and researchers.

This ruling enables qualified individuals to receive a tax-free allowance of up to 30% of their gross salary, thereby lowering their taxable income.

This incentive is designed to attract and retain top talent from around the world, enhancing the Netherlands' appeal as a prime destination for international careers.

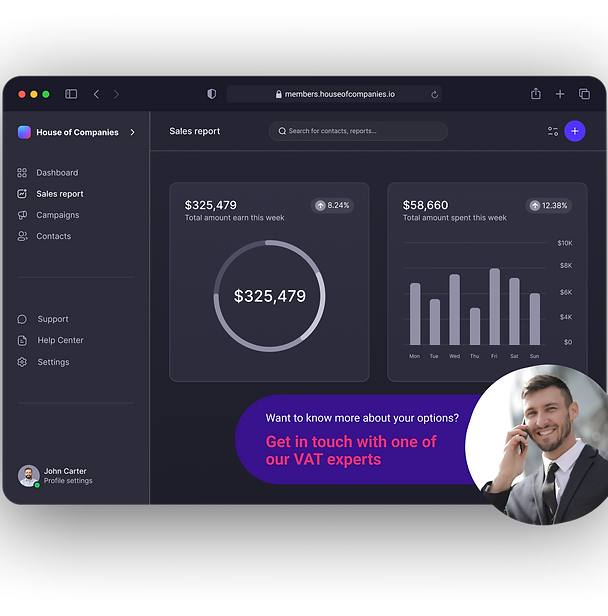

Our Portal provides a comprehensive overview of every step required to activate your 30% Ruling in the Netherlands. Known as the expat tax advantage, the 30% ruling offers eligible highly skilled professionals a tax-free allowance, significantly reducing taxable income.

With our portal, you can easily track all milestones and documentation needed to apply for and secure the 30% ruling. We guide you through each phase, ensuring a smooth process from eligibility verification to application submission, making it simple for you to take advantage of this valuable financial benefit.

The 30% Ruling in the Netherlands is designed for highly skilled expatriates who are recruited or transferred by a Dutch employer from abroad. To qualify, you must meet several criteria. Firstly, you must possess specialized skills or expertise that are not readily available in the Dutch labor market, making you a valuable asset to your employer. Additionally, you should not have lived within 150 kilometers of the Dutch border for at least 16 of the 24 months prior to your employment.

This criterion ensures that the ruling benefits individuals who are relocating from abroad rather than those already within the EU. Furthermore, the application for the 30% Ruling must be made within four months of starting your employment to receive the full benefit retroactively. Our expert team assists in verifying your eligibility based on these criteria, ensuring that you meet all requirements before submitting your application to maximize your tax benefits in the Netherlands.

To qualify for the 30% Ruling in the Netherlands, you must meet specific eligibility criteria established by the Dutch tax authorities. Firstly, you need to be an expatriate who is recruited or transferred from abroad to work for a Dutch employer. Your expertise should be specialized and not readily available within the Dutch labor market. This typically means you possess skills that are scarce or unique, making you a valuable asset to the company.

Additionally, you must not have resided within 150 kilometers of the Dutch border for at least 16 of the 24 months preceding your employment in the Netherlands. The application must be submitted within four months of your employment start date to ensure you receive the full benefit of the ruling. It’s also crucial that you and your employer have a clear and valid employment contract. Our expert team is adept at navigating these requirements and can provide guidance to ensure that all conditions are met, thereby maximizing your chances of a successful application and ensuring compliance with Dutch tax regulations.

Calculating your potential savings with the 30% Ruling involves several key factors. This ruling allows expatriates to receive up to 30% of their gross salary tax-free, which directly reduces taxable income and increases net earnings. To estimate your savings, start by determining your gross salary and applying the 30% tax-free allowance. For example, if your gross salary is €80,000, up to €24,000 (30% of €80,000) can be received tax-free. This means you will only pay tax on €56,000 of your salary, effectively reducing your taxable income by €24,000.

Additionally, the 30% Ruling can impact other areas such as social security contributions and pension savings, potentially increasing your overall financial benefit. For a precise calculation, consider your specific salary structure, any additional benefits, and your individual tax situation. Our experts provide tailored calculations and insights, helping you fully understand how the 30% Ruling affects your finances and ensuring that you maximize the benefits of this tax advantage.

Verify Eligibility: Confirm that you meet the criteria, including being recruited or transferred to the Netherlands from abroad, possessing specialized skills, and not having lived within 150 kilometers of the Dutch border for the past 16 out of 24 months.

Gather Documentation: Collect all necessary documents, such as your employment contract, proof of previous residence, and details about your skills and expertise. Ensure that these documents are accurate and up-to-date.

Complete the Application Form: Fill out the 30% Ruling application form provided by the Dutch tax authorities. Ensure all information is correct and complete, including personal, employment, and tax details.

Submit the Application: Send your completed application and supporting documents to the Dutch tax authorities. This can typically be done online or by mail.

Follow Up: Monitor the status of your application and respond promptly to any requests for additional information from the tax authorities.

Receive Approval: Once approved, the 30% Ruling will be applied to your salary, and you'll start enjoying the tax benefits.

To successfully apply for the 30% Ruling in the Netherlands, specific documentation is required to substantiate your eligibility and ensure a smooth application process. The primary documents include:

Employment Contract: This should outline the terms of your employment, including your salary and job role, demonstrating your expertise and the necessity of the tax advantage.

Proof of Previous Residence: Documentation showing your residence outside the 150-kilometer boundary of the Dutch border for at least 16 of the past 24 months.

Proof of Specialized Skills: Evidence that your skills or expertise are rare or unavailable in the Dutch labor market.

Identification Documents: A copy of your passport or national ID to confirm your identity.

Tax Identification Number: Your Dutch tax identification number, necessary for processing the application.

Our team assists in gathering and preparing these documents, ensuring they meet Dutch tax authorities' requirements. Proper documentation is crucial to avoid delays or rejections, and we provide expert guidance to ensure your application is complete and accurate.

Filling out the 30% Ruling application form accurately is crucial for a successful claim. Start by gathering all necessary documentation, including your employment contract and proof of your specialized skills. Begin the form by entering your personal details such as name, address, and date of birth. Next, provide comprehensive information about your employment, including your job title, the nature of your work, and your employer’s details. Be sure to detail your previous residence history to confirm you meet the eligibility requirements.

Additionally, include information about your expertise and how it aligns with the criteria for the 30% Ruling. It’s important to cross-check all entries for accuracy and completeness to avoid delays. Mistakes or incomplete information can lead to rejection or complications in processing. Once the form is completed, review it thoroughly before submission to the Dutch tax authorities. For added assurance, consider having our experts review your application to ensure it meets all requirements and is submitted correctly, maximizing your chances of approval.

Applying for the 30% Ruling can be complex, and several common mistakes can jeopardize your application.

Additionally, neglecting to provide accurate details about your specialized skills and expertise can undermine your application. To avoid these pitfalls, work with our experts who offer guidance on every step of the process, ensuring your application is complete, accurate, and submitted on time.

If your 30% Ruling application is rejected, the first step is to carefully review the rejection letter from the Dutch tax authorities. The letter will typically include reasons for the denial, which could be related to eligibility criteria, incomplete documentation, or procedural errors.

Address the specific issues mentioned in the rejection by gathering any additional documentation or correcting errors. It’s crucial to ensure that all information is accurate and meets the requirements set forth by the tax authorities.

Next, you can submit an appeal or reapply for the ruling. The appeal process involves drafting a formal objection to the rejection, providing any new evidence or clarifications. This must be done within the stipulated timeframe to be considered valid.

Our experts can assist you through this process by reviewing your application, helping prepare your appeal, and liaising with the tax authorities. We ensure that all potential issues are addressed comprehensively, increasing the likelihood of a successful outcome.

Q: What is the 30% Ruling?

A: The 30% Ruling is a Dutch tax advantage allowing expatriates to receive up to 30% of their gross salary tax-free. It aims to attract skilled professionals to the Netherlands by offering financial incentives.

Q: Who qualifies for the 30% Ruling?

A: The ruling applies to expatriates with specialized skills hired by Dutch employers who relocate from abroad. Eligibility requires the employee to have lived outside a 150-kilometer radius from the Dutch border for 16 of the last 24 months.

Q: How long can I benefit from the 30% Ruling?

A: Initially, the ruling is granted for up to 5 years. In some cases, it may be extended, but the total benefit period cannot exceed 5 years.

Q: Can the 30% Ruling be extended?

A: Extensions are possible in specific situations, such as if you previously received the ruling but did not use the full 5 years. Extensions are subject to approval by Dutch tax authorities.

Q: What happens if I change employers?

A: The 30% Ruling remains valid if you change employers, provided the new job meets the criteria. Your new employer must apply for the ruling on your behalf.

Q: How does the 30% Ruling affect my pension contributions?

A: The 30% Ruling may impact your pension contributions. Tax-free income can influence how your contributions are calculated, so consult with a financial advisor to understand the implications for your pension plan.

Once you've received approval for the 30% Ruling, it's crucial to follow a few key steps to ensure you fully benefit from this tax advantage. First, update your payroll details with your employer to reflect the 30% tax-free allowance, ensuring your net salary accurately reflects the tax relief. Regularly review your tax situation and keep track of any changes in your employment status or personal circumstances, as these could affect your eligibility or benefits.

Additionally, stay informed about Dutch tax regulations and any updates to the 30% Ruling that might impact your situation. Our team offers ongoing support and advisory services to help you navigate any changes and optimize your tax position. We also provide assistance with annual tax filings and compliance checks to ensure you maintain eligibility for the ruling and avoid any potential issues.

"30% Ruling application process seamless. Their guidance and efficient portal saved me time and helped me secure the benefits I was entitled to. Highly recommended for anyone relocating to the Netherlands.”

John.,IT Consultant

John.,IT Consultant“Navigating Dutch tax regulations can be daunting, but [Your Company] made it easy. Their portal was user-friendly, and their support team was incredibly responsive. I couldn’t have asked for a better experience.”

Sara L., Marketing Specialist

Sara L., Marketing Specialist“The service provided was exceptional. From the initial consultation to the final approval, handled everything with professionalism and clarity. Their expertise ensured I received the maximum benefits from the 30% Ruling.”

Ahmed R., Financial Analyst

Ahmed R., Financial AnalystLorem ipsum dolor sit amet consectetur adipiscing elit aliquam mauris sed ma