Manage your entity or launch a local business with the help of our free demo portal.

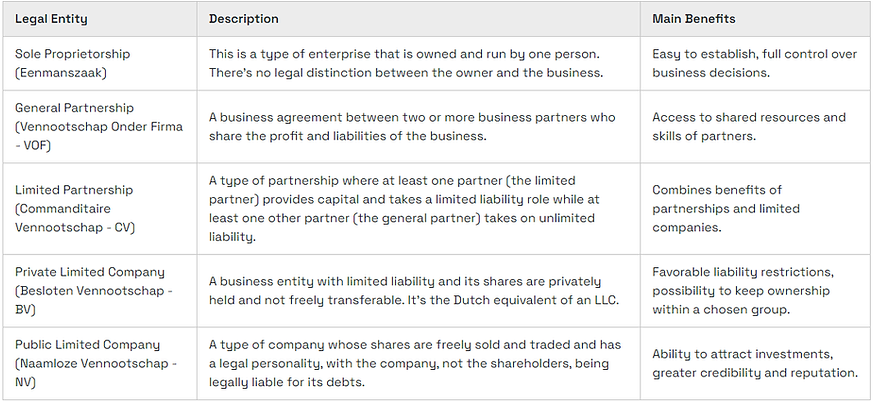

We start by helping you pick a sole proprietorship (Eenmanszaak), private limited company (BV), or overseas company branch. We ensure that your structure matches your operational aims and long-term strategy by assessing your company goals. This critical phase influences tax responsibilities, liabilities, and operating freedom.

Once a corporate structure is chosen, we help prepare and submit the relevant paperwork to the Dutch Chamber of Commerce. This comprises business name registration, trade license issuance, and VAT number application. We ensure all registrations comply with Dutch commercial legislation and municipal and national laws.

Our entity management services include registration and continuous support to keep your firm compliant with Dutch legislation. This includes yearly filings, tax compliance, payroll administration, and other customized administrative services. Our customer support staff is accessible to answer questions, inform you on regulatory changes, and manage company growth challenges.

We provide more than registration services; we give you a complete solution that lets you focus on building your business. With our expertise and devotion, you may join the Dutch market with confidence, knowing that specialists will manage all company setup and maintenance. We make growing abroad or launching a new business in the Netherlands easy from start to end.

Choosing a name for your Dutch BV (Besloten Vennootschap) is an important step in establishing your business identity. The name should reflect the nature of your business and be memorable for customers. It must align with your brand image and convey the right message to your target audience. A well-chosen name can enhance recognition and trust in the marketplace.

When selecting a name, ensure that it complies with Dutch legal requirements. The chosen name must be unique and not too similar to existing businesses. The Dutch Chamber of Commerce (KvK) maintains a registry where you can check the availability of your desired name. If a name is already in use or too similar, it will be rejected, so performing this check early on is crucial.

Additionally, the name must include the abbreviation "BV" to indicate its legal structure. This informs potential partners, clients, and customers that your business operates as a private limited company. The name must also avoid any misleading terms that could suggest government affiliation or misrepresent the nature of the business.

Another key consideration is the international aspect of your business. If you plan to operate in multiple countries, choosing a name that is easy to pronounce and understand in different languages can prevent confusion. It’s also advisable to check whether the domain name for your business is available for online presence purposes.

In a Dutch BV (Besloten Vennootschap), shareholders benefit from limited liability, meaning their financial risk is typically limited to their investment in the company. This protection is a significant advantage, as it safeguards personal assets from business debts and liabilities. If the BV encounters financial difficulties or is sued, shareholders are generally not liable for the company's obligations beyond their capital contribution.

However, limited liability is not absolute. In certain circumstances, shareholders may face personal liability, particularly if they are found to have acted unlawfully or recklessly. For example, if shareholders fail to adhere to corporate governance principles or engage in fraudulent activities, courts can lift the veil of incorporation, holding them personally responsible for the company's debts.

The legal structure of a Dutch BV also requires proper financial management and transparent accounting practices. Shareholders must ensure that the company maintains accurate financial records and complies with statutory obligations. Failure to do so can result in liability for unpaid taxes or penalties, which could extend to shareholders if the company is found negligent in its financial dealings.

Moreover, Dutch law provides legal protections for minority shareholders. Specific regulations prevent majority shareholders from abusing their power, ensuring that minority interests are safeguarded. Minority shareholders have rights to information, participation in decision-making, and protection against unfair treatment, which enhances their position within the company.

The articles of association of a Dutch BV outline the rights and obligations of shareholders, including provisions related to governance and decision-making processes. These documents can provide additional layers of legal protection by clearly defining the roles and responsibilities of shareholders, thus reducing the risk of disputes.

Seamless registration services aim to simplify the process of establishing a business, allowing entrepreneurs to focus on their core activities. These services typically cover a range of essential steps, including business name registration, obtaining necessary licenses, and securing tax identification numbers. By providing a streamlined approach, seamless registration services reduce the complexity often associated with starting a business.

When utilizing seamless registration services, clients can expect personalized assistance tailored to their specific needs. This includes consultations to understand the unique requirements of their business structure, whether it’s a sole proprietorship, partnership, or corporation. Experts will guide clients through the necessary documentation and legal obligations, ensuring compliance with local regulations.

Another key feature of seamless registration services is the use of technology to enhance efficiency. Many providers leverage online platforms that allow clients to submit documents, track progress, and receive notifications in real-time. This digital approach not only speeds up the registration process but also minimizes the chances of errors or omissions that could delay approval.

Additionally, seamless registration services often offer comprehensive packages that include ongoing support beyond initial registration. This may encompass assistance with annual filings, changes in business structure, and updates to licenses or permits. Such ongoing support ensures that businesses remain compliant as they grow and evolve.

Moreover, seamless registration services can provide insights into industry-specific regulations that may affect a business. Understanding these nuances helps entrepreneurs navigate the complexities of their respective markets and avoid potential pitfalls. Access to expert advice can be invaluable in maintaining compliance and promoting sustainable growth.

Finally, seamless registration services foster a positive experience for entrepreneurs by minimizing stress and uncertainty. By handling the administrative burdens associated with business registration, these services enable clients to dedicate their time and resources to building and expanding their businesses effectively.

Fill out the form below to register.

Registering your BV (Besloten Vennootschap) with the Dutch Chamber of Commerce (KVK) is a crucial step in establishing your business in the Netherlands. The KVK serves as the official registry for all companies in the country, ensuring that businesses operate transparently and adhere to legal requirements. This registration provides essential information about your company to the public, including its legal structure, activities, and financial status.

To initiate the registration process, you must gather all necessary documents. This typically includes a valid identification document, your business plan, and details about the shareholders and directors. Additionally, you’ll need to specify the business activities you intend to engage in. It's important to ensure that these activities align with the codes used by the KVK, as this will determine your company's classification.

Once you have your documents ready, you can schedule an appointment at your local KVK office. During this appointment, a KVK representative will guide you through the registration process. You'll need to complete the registration form and provide the required documentation. The KVK will then verify the information, ensuring that everything is in order.

Upon successful registration, your BV will receive a unique registration number, which serves as your business identity within the KVK system. This number is essential for various administrative purposes, including tax filings and opening a business bank account. The KVK will also provide you with an official extract from the register, which can be used as proof of your company’s existence.

After registration, it is crucial to keep your KVK information updated. Any changes in your company structure, such as alterations in directorship, shareholding, or business activities, must be reported to the KVK promptly. This ensures compliance with Dutch regulations and maintains the accuracy of the public registry.

Compliance with Dutch employment laws is crucial for a Dutch Besloten Vennootschap (BV) to operate smoothly and avoid legal pitfalls. One of the foundational aspects of Dutch employment law is the requirement to have written employment contracts. These contracts should clearly outline the terms of employment, including job responsibilities, salary, working hours, and termination conditions. Having a well-drafted contract helps both employers and employees understand their rights and obligations.

Another important aspect is the adherence to the Dutch minimum wage laws. Employers must ensure that they pay their employees at least the statutory minimum wage, which is regularly updated. This applies to all employees, regardless of their age or employment status, and non-compliance can lead to significant fines and legal issues. Employers should also stay informed about changes to wage regulations to maintain compliance. Dutch employment laws also emphasize the importance of providing employees with statutory leave entitlements. This includes vacation days, sick leave, and parental leave.

Employers are required to track these entitlements carefully and ensure that employees can utilize their leave without facing retaliation. Failing to grant these leaves can result in legal consequences and damage to the company’s reputation. Additionally, employers in the Netherlands must comply with regulations related to working hours and conditions. The Working Hours Act sets out rules regarding maximum working hours, rest periods, and overtime compensation. Employers should implement policies that align with these regulations to promote a healthy work environment and prevent labor disputes.

Navigating the Dutch corporate tax system requires a solid understanding of its key features and regulations. One of the most critical aspects is the corporate tax rate, which is set at 25.8% for profits exceeding €200,000 as of 2024. For profits below this threshold, a lower rate of 15% applies, making the system progressive and beneficial for small and medium-sized enterprises (SMEs).

Another essential element is the participation exemption, which allows Dutch companies to receive dividends and capital gains from their subsidiaries tax-free, provided they hold at least 5% of the shares. This exemption encourages businesses to invest and expand internationally without incurring additional tax burdens on repatriated profits.

Filing requirements in the Netherlands are also significant. Corporations must submit their annual tax returns within five months after the end of their financial year. Extensions can be requested, but it's crucial to maintain accurate records and comply with deadlines to avoid penalties. Companies can choose their fiscal year, allowing for flexibility in tax planning.

The Dutch tax system also includes various deductions and incentives aimed at fostering innovation and sustainability. For example, the Innovation Box regime allows companies that generate income from innovative activities to benefit from a significantly reduced effective tax rate on that income. This initiative is designed to encourage research and development efforts within the country.

International taxation considerations are vital for businesses operating across borders. The Netherlands has an extensive network of tax treaties that help mitigate double taxation and provide clarity on tax obligations in different jurisdictions. Companies must be aware of transfer pricing regulations, ensuring that transactions between related parties reflect market conditions.

Lastly, businesses should consider engaging local tax advisors to navigate the complexities of the Dutch corporate tax system effectively. These professionals can provide valuable insights into compliance, planning strategies, and the implications of recent tax reforms, ultimately helping companies optimize their tax position.

A Dutch BV (Besloten Vennootschap) must meet various ongoing obligations related to financial reporting and auditing. These obligations ensure transparency, accuracy, and compliance with Dutch corporate law. Below is a breakdown of some key aspects:

A Dutch BV is required to prepare and file annual financial statements. These must be prepared within five months of the end of the financial year, and a general shareholders' meeting must approve them within two months. The financial statements include the balance sheet, profit and loss account, and notes explaining the financial data. Failure to comply with this can result in penalties and potential legal liabilities for the directors.

After the approval of the financial statements, they must be submitted to the Dutch Chamber of Commerce within eight days. The BV’s size (small, medium, or large) determines the level of detail required in the publication. For example, small BVs are exempt from filing a full balance sheet and are only required to file a simplified version of their financials. Non-compliance may lead to fines or legal consequences.

Whether or not a Dutch BV needs an audit depends on its size. Large and medium-sized BVs are required to have their annual financial statements audited by an independent, certified auditor. Small BVs are exempt from this requirement. The auditor will assess the accuracy of the financial statements, ensuring they provide a true and fair view of the company's financial position.

The Dutch BV (Besloten Vennootschap), a private limited liability company, is known for its flexibility in structuring, allowing businesses to tailor their operations and governance according to their specific needs. This flexibility stems from the minimal capital requirements, broad shareholder rights, and customizable governance structure. Companies can easily adjust their shareholding, capital distribution, and decision-making processes, which makes the Dutch BV an attractive vehicle for both small and large enterprises looking for operational agility and international expansion.

Determine the Shareholder Structure

Draft and Sign the Articles of Association

Appoint Directors and Define Roles

Determine Capital Contributions

Establish Voting Rights and Decision-Making Processes

Register the BV with the Dutch Chamber of Commerce

Ensure Compliance with Dutch Corporate Regulations

This structuring flexibility makes the Dutch BV an attractive choice for entrepreneurs and investors alike.

Using a virtual office address for your Dutch BV can be a strategic and practical solution, particularly for startups and small businesses. A virtual office allows you to establish a business presence in the Netherlands without the need for a physical office. This can significantly reduce operational costs, making it an attractive option for companies looking to enter the Dutch market.

One key benefit of a virtual office is that it provides a professional business address, which can enhance your company's credibility. This is especially important when dealing with Dutch clients or partners who expect a local presence. A virtual office address also allows you to keep your personal address private, ensuring a clear separation between your business and personal life.

In addition to the credibility it provides, a virtual office address can also help you meet the legal requirements for establishing a Dutch BV. Dutch law mandates that a BV must have a registered address in the Netherlands. A virtual office fulfills this requirement, allowing businesses to comply with local regulations without needing to lease or buy physical office space.

Virtual offices often come with additional services, such as mail forwarding and phone answering. These services can enhance your business operations by ensuring that you never miss important communications, even if you're operating remotely. Many virtual office providers also offer meeting rooms and coworking spaces, giving you the option to meet clients or partners in a professional setting when needed.

For businesses that operate internationally, using a virtual office in the Netherlands can simplify cross-border transactions. It establishes a local point of contact, which can make it easier to build relationships with Dutch customers, suppliers, and partners. This localized presence can also give you access to Dutch business networks and resources.

Using a virtual office can also be a tax-efficient choice. By having a registered Dutch business address, your BV may be able to take advantage of certain local tax benefits or deductions. Additionally, the Netherlands offers an attractive corporate tax regime, which can be a key reason for choosing this setup.

Flexibility is another major advantage of a virtual office. Whether you're expanding into new markets or scaling down operations, a virtual office allows you to adapt quickly without the hassle of physical office leases. This can be particularly valuable in the rapidly changing business environment.

In terms of administrative tasks, a virtual office address can streamline your business operations. Many providers offer digital tools to manage mail, scheduling, and communication, allowing you to focus on core business activities. This convenience can free up time for entrepreneurs and managers.

Overall, using a virtual office for your Dutch BV is a cost-effective and flexible solution that can enhance your company's professionalism, compliance, and efficiency.

Registering a Dutch BV (Besloten Vennootschap) can be a complex process, especially for foreign entrepreneurs unfamiliar with Dutch laws and regulations. Partnering with local experts simplifies the process, ensuring compliance with all legal requirements and providing valuable insights into the Dutch market. These professionals help navigate the paperwork, verify required documentation, and liaise with Dutch authorities, allowing you to focus on your business. With their guidance, the registration can be faster, smoother, and more efficient, preventing costly mistakes or delays.

Using technology in business registration services has streamlined the entire process, making it more efficient and accessible. Traditional registration methods involved paperwork, long waiting times, and multiple visits to government offices. Today, with the integration of digital platforms, businesses can be registered online, reducing the time and effort required for entrepreneurs.

One significant advantage of using technology in business registration is the automation of processes. Automated systems can guide users step-by-step through the registration, ensuring that all necessary forms and documentation are completed correctly. This minimizes human error and increases the accuracy of the information submitted.

Cloud-based platforms have also played a crucial role in modernizing business registration services. Entrepreneurs can now store and retrieve their documents securely online. This enables businesses to access their registration details from anywhere, at any time, fostering a more flexible and convenient process.

Moreover, e-signatures have revolutionized the way documents are signed and submitted during the registration process. By eliminating the need for physical signatures, e-signatures speed up the approval process and further reduce the reliance on paper-based systems, which are more prone to delays.

Technology has also improved the transparency of business registration services. Entrepreneurs can track the progress of their applications in real time. This transparency builds trust in the system, allowing businesses to stay informed about any delays or requirements for additional documentation.

Artificial intelligence (AI) is another key player in enhancing the registration process. AI tools can analyze submitted documents for compliance, ensuring that they meet all regulatory requirements before submission, saving time and preventing rejection.

Additionally, online payment systems integrated into registration platforms offer seamless fee transactions, allowing entrepreneurs to pay their registration fees digitally. This eliminates the need for physical payment methods like checks or cash.

Lastly, technology has made business registration more accessible to small businesses and startups. Entrepreneurs from remote locations can easily access registration services without needing to travel, encouraging business growth across wider regions.

A Dutch BV (Besloten Vennootschap) is a private limited liability company that offers many advantages for both local and foreign entrepreneurs in the Netherlands. It's the most common business structure in the country due to its flexibility, limited liability for shareholders, and clear regulations. A BV can be established with a minimum share capital of just €0.01, making it accessible for small businesses and startups. Shareholders are only liable up to the amount of their shares, which provides personal financial protection. A BV also enjoys favorable tax treatments and the ability to attract investors through shares.

The key difference between a Dutch BV and a sole proprietorship is the level of liability. In a sole proprietorship, the owner is personally liable for all business debts and obligations. This means that personal assets are at risk if the business encounters financial difficulties. In contrast, the Dutch BV limits liability to the company itself, protecting shareholders from personal risk. Additionally, a BV offers more tax planning opportunities, while sole proprietorships are simpler to set up but may face higher personal tax rates.

The Dutch NV is another popular business structure, primarily used by larger corporations. Unlike a BV, which is privately held, an NV can issue shares to the public and be listed on the stock exchange. This makes it suitable for larger companies looking to raise capital through public offerings. However, an NV requires a higher minimum capital investment (€45,000), and its administrative obligations are more complex. A BV, on the other hand, is often preferred by small and medium-sized enterprises (SMEs) due to its simpler setup and lower capital requirements.

A partnership, such as a general partnership (VOF) or limited partnership (CV), is another common business structure in the Netherlands. In a VOF, all partners are personally liable for the business’s debts, similar to a sole proprietorship. A CV limits liability for limited partners but not for general partners. In contrast, the BV provides a shield of limited liability for all shareholders. Partnerships are often chosen for simpler operations or family businesses, while a BV is more suited to companies looking for growth, investors, or international operations.

Am I prepared to launch my Entity?

I am prepared to begin trading.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!