Introduction

Are you considering starting a business in the Netherlands? Well, you might be delighted to learn about the attractive tax incentives that await you. The Netherlands government offers a range of tax benefits and exemptions, designed to encourage and support entrepreneurs. From reduced corporate tax rates to deductions for research and development investments, these incentives can significantly boost your business’s profitability and growth potential.

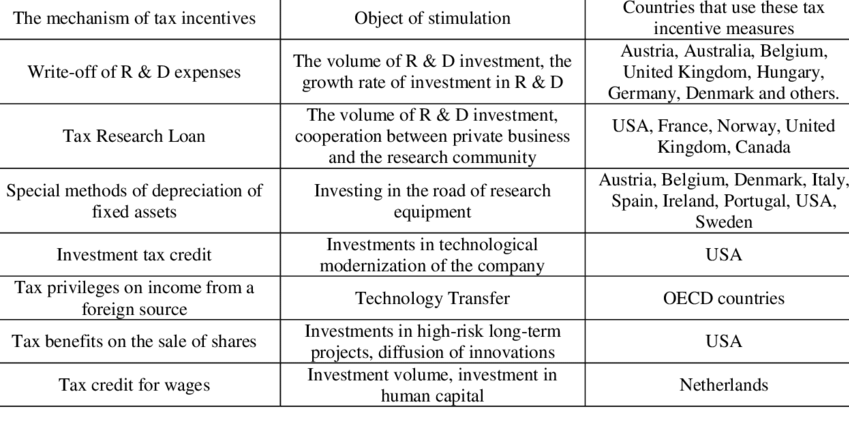

Types Of Tax Incentives Available

Corporate Tax Incentives For Businesses

The Netherlands offers a range of corporate tax incentives to attract businesses and promote economic growth. One of the key incentives is the Innovation Box, which allows qualifying businesses to benefit from a reduced tax rate of only 9% on their innovative profits. This incentive is designed to encourage businesses to invest in research and development activities and bring innovative products and services to the market. By taking advantage of this incentive, you can save a substantial amount on your tax bill, thereby freeing up more capital to reinvest in your business.

Another corporate tax incentive is the participation exemption, which exempts qualifying businesses from paying tax on profits derived from qualifying shareholdings. This incentive aims to encourage businesses to invest in other companies and foster economic collaboration. By benefiting from the participation exemption, you can maximize your return on investment and expand your business network.

Personal Income Tax Incentives For Business Owners

As a business owner in the Netherlands, you can also benefit from several personal income tax incentives. The first is the self-employed tax deduction, which allows self-employed individuals to deduct a fixed amount from their taxable income. This deduction helps reduce the tax burden on entrepreneurs and encourages self-employment.

In addition to the self-employed tax deduction, the Netherlands offers the small-scale investment deduction, which allows business owners to deduct a percentage of their investments in assets for their business. This incentive aims to stimulate business investment and growth by providing tax relief for those who invest in new equipment, machinery, or other assets.

Value Added Tax (VAT) Incentives

The Netherlands also provides VAT incentives to support businesses. One such incentive is the VAT exemption for small businesses. If your annual turnover is below a certain threshold, you may be eligible for this exemption, which means you don’t have to charge VAT on your products or services. This can be a significant advantage for small businesses, as it reduces administrative burdens and makes their offerings more competitive in the market.

Additionally, for businesses that import goods into the Netherlands, there is a VAT deferment scheme. This scheme allows businesses to defer payment of VAT on imports, providing them with more flexibility in managing their cash flow.

Research And Development (R&D) Tax Incentives

The Netherlands is renowned for its innovation and investment in research and development. As a result, the government offers generous tax incentives to businesses engaged in R&D activities. One such incentive is the R&D tax credit, which allows businesses to claim a percentage of their R&D expenses as a tax credit. This credit can be used to offset corporate income tax or even be received as a cash refund.

Furthermore, the Netherlands has a patent box regime, which provides a reduced tax rate on profits derived from patented inventions. This incentive aims to encourage businesses to protect their intellectual property and invest in innovative solutions. By benefiting from the patent box regime, you can not only reduce your tax liability but also enhance the value of your intellectual assets.

Other Tax Incentives And Exemptions

Apart from the aforementioned incentives, the Netherlands offers various other tax incentives and exemptions to promote entrepreneurship. For instance, businesses that invest in energy-saving assets can benefit from accelerated depreciation allowances, allowing them to deduct a larger portion of the asset’s value from their taxable income in the earlier years.

Additionally, the Netherlands has generous rules regarding the carry-forward and carry-back of tax losses. This means that if your business incurs losses in a particular year, you can offset those losses against profits in future years or even against profits from the past, providing you with valuable tax relief during challenging times.

How To Qualify For Tax Incentives In The Netherlands

To qualify for tax incentives in the Netherlands, certain conditions and criteria must be met. The specific requirements vary depending on the type of incentive you are seeking. For example, to benefit from the Innovation Box, your business must hold a qualifying intellectual property right and derive income from this IP.

Similarly, to qualify for the R&D tax credit, your business must engage in qualifying R&D activities, and the expenses incurred must meet certain criteria. It is crucial to carefully review the eligibility criteria and seek professional advice to ensure that your business meets all the necessary requirements.

Common Misconceptions About Tax Incentives

While tax incentives can be highly beneficial for businesses, there are also some common misconceptions that need to be addressed. One misconception is that tax incentives are only available for large multinational corporations. In reality, many incentives are designed to support small and medium-sized enterprises (SMEs) as well. It’s important for entrepreneurs of all sizes to explore the available incentives and determine which ones are most relevant to their business.

Another misconception is that tax incentives are complicated and difficult to navigate. While tax regulations can be complex, seeking professional advice from tax experts can help you understand the requirements and ensure compliance. By working with experienced professionals, you can maximize the benefits of tax incentives and avoid any potential pitfalls.

Conclusion

By opening a business in the Netherlands, you not only gain access to a thriving European market but also benefit from the government’s commitment to supporting entrepreneurship through its tax system. The attractive tax incentives available can significantly enhance your business’s profitability, stimulate innovation, and provide a competitive advantage in the market. So, don’t miss out on the opportunity to make the most of these tax incentives and establish your business in the Netherlands.

Remember, tax regulations and incentives are subject to change, so it’s essential to stay informed and consult with tax professionals to ensure your business remains compliant and takes full advantage of all available opportunities. With the right expertise and strategic planning, you can navigate the tax landscape in the Netherlands and position your business for long-term success.