In the Netherlands has established itself as a global business hub for multinational companies and organizations. Its central location in Europe, coupled with its well-developed infrastructure and favorable tax regime, makes it a preferred destination for businesses seeking to manage their international operations efficiently. The country provides access to key European markets while maintaining strong business ties with non-EU countries.

Dutch government has fostered an environment conducive to international business, with clear, transparent legal frameworks, well-functioning regulatory authorities, and a highly skilled workforce. These factors make the Netherlands an ideal base for companies seeking to set up entities, manage legal compliance, and streamline governance processes. For companies operating worldwide, including in non-EU countries, the Netherlands offers a stable and attractive platform for growth and expansion.

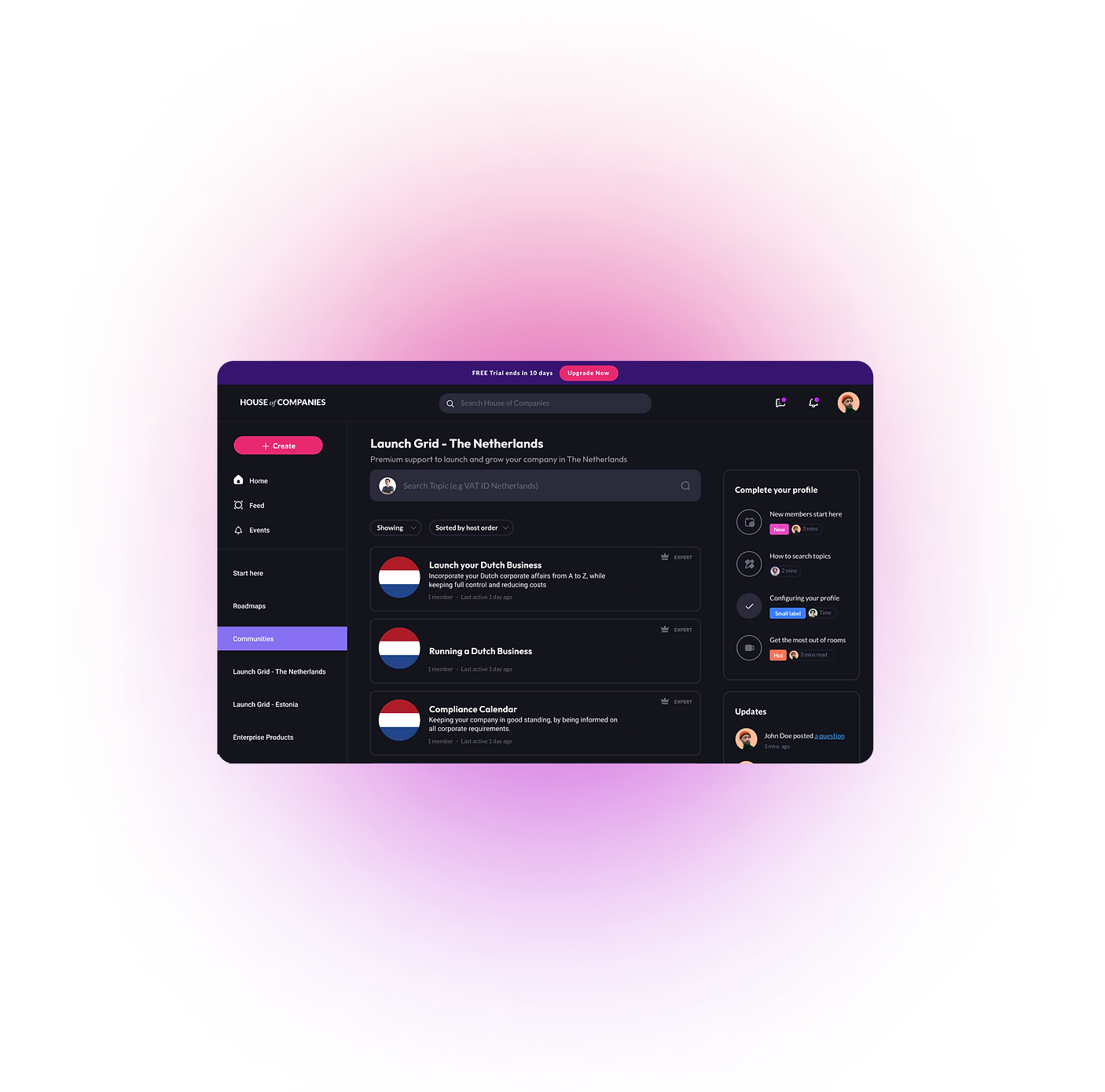

Entity management services assist with establishing a company in the Netherlands, handling everything from legal documentation to registration with Dutch authorities, ensuring compliance with local laws.

These services help businesses navigate the Dutch tax system, manage tax filings, VAT registrations, and strategic planning to optimize tax benefits and ensure compliance with local regulations.

Providing a local address for official correspondence and legal documentation, these services ensure businesses meet the requirement for a registered office in the Netherlands without needing physical office space.

Supporting accurate and timely submission of annual financial statements and other regulatory documents, these services ensure compliance with Dutch statutory requirements and deadlines.

Services assist in preparing consolidated financial statements for multinational companies, ensuring compliance with Dutch and international accounting standards and accurate financial reporting.

For businesses operating across multiple jurisdictions, particularly those in non-EU countries, navigating regulatory landscapes can be highly complex. Every country has its own legal, tax, and corporate governance requirements, which can vary significantly from those of the European Union. The Netherlands, with its well-established legal system and business-friendly policies, serves as a reliable base for managing such operations, offering comprehensive entity management services tailored to non-EU businesses. These services help companies effectively manage compliance with local and international regulations, reducing the risks associated with cross-border operations.

Non-EU countries often impose different corporate structures, legal obligations, and reporting requirements. Companies operating in these regions must stay current with local laws, tax regulations, and other business obligations, which can be particularly challenging for organizations with a global footprint. Entity management services based in the Netherlands provide centralized solutions, ensuring that each entity complies with the specific regulations of the non-EU countries in which they operate. This includes setting up compliant corporate structures, managing required registrations, and overseeing the preparation of legal documentation that aligns with local laws.

Non-EU countries often have unique compliance challenges, such as different tax regimes, foreign investment restrictions, and distinct requirements for the submission of annual financial reports. For instance, non-EU jurisdictions may have stricter requirements for foreign entities in terms of capital requirements, ownership restrictions, or corporate governance frameworks. Dutch entity management providers are well-versed in the regulatory environments of various non-EU countries and can assist businesses in understanding and meeting these obligations, offering strategic solutions that help businesses maintain their legal standing.

Compliance with international financial reporting standards (IFRS) can vary between non-EU jurisdictions. While some non-EU countries align with IFRS, others may follow local Generally Accepted Accounting Principles (GAAP), which can differ significantly from European standards. Dutch entity management services ensure that companies operating in non-EU countries can navigate these differences by preparing accurate financial statements, organizing external audits when necessary, and coordinating with local auditors or regulatory authorities. These services enable businesses to meet their non-EU compliance obligations efficiently while benefiting from the Netherlands' advantageous business environment.

Entity Management Services include managing company compliance, governance, and reporting requirements, ensuring your business adheres to Dutch regulations.

These services help streamline compliance, reduce administrative burdens, and ensure timely filing of necessary documents, allowing your company to focus on core activities.

Key requirements include maintaining accurate records, filing annual financial statements, and adhering to corporate governance standards as per Dutch laws.

Feel welcome, and try out our solutions. We can prepare a sample Annual Statement based on your current numbers, so you experience the simplicity of our portal!

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!