Our Entity Management services extend globally, supporting businesses across EU and non-EU countries, with a primary focus on the Netherlands.

We help companies establish, maintain, and manage their legal entities, ensuring full compliance with local regulations, governance standards, and corporate laws.

Our VAT Reporting services ensure your company remains fully compliant with all relevant VAT laws, reducing administrative burdens and minimizing the risk of fines or penalties.

Let's get started!

"I expected to take about 2 quarters to generate turnover in Germany. Luckily I didn’t have to spend any money on an accountant in the meantime."

John Smith

John Smith"My Indian accountant drafts my VAT Reports, and submits the return using Entity Management!!"

Deny

Deny"The practical known how is entity managemant made me comfort to get more involve my own tax filling! And it's worked!"

Rose

RoseAll you known about VAT requirement for your new business

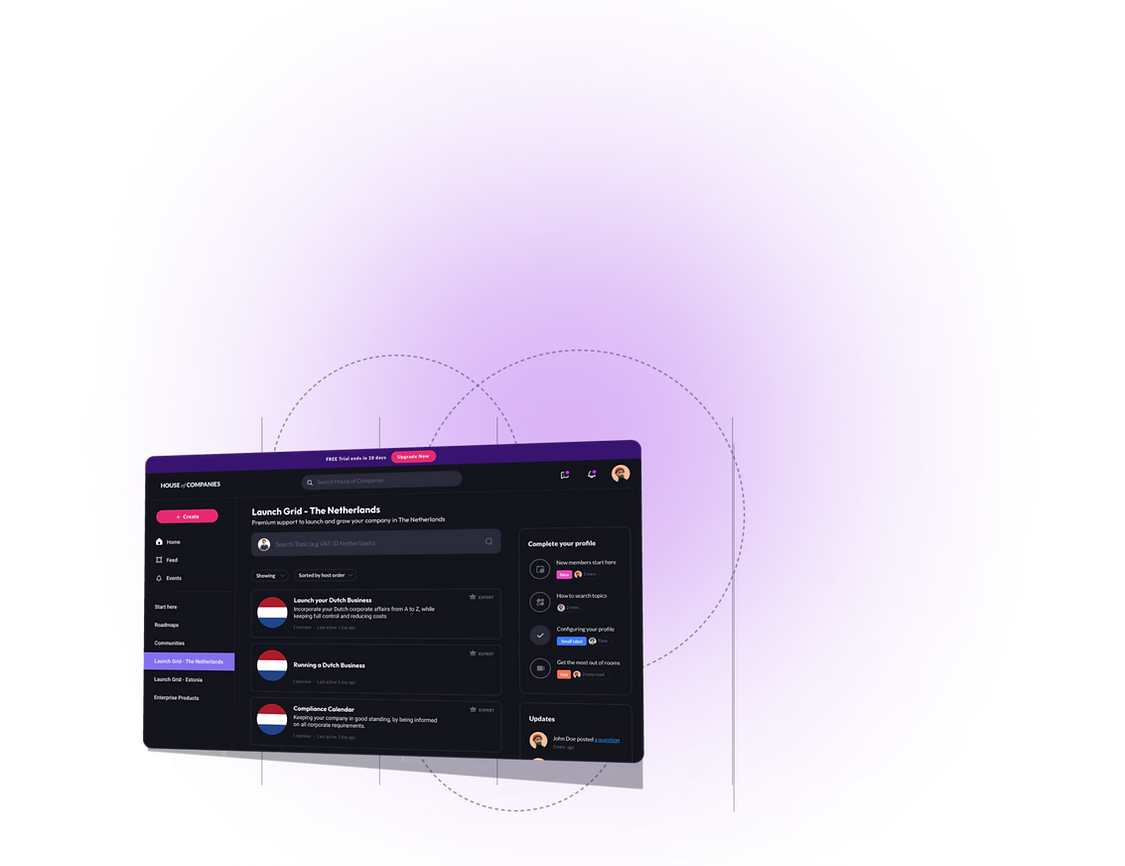

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!