"We chose the Netherlands for our global expansion, and the tax advisory team exceeded our expectations. They ensured seamless compliance and advised us on maximizing tax benefits."

Exceptional Expertise

Exceptional Expertise"Their accounting compliance service was a game changer. The team is proactive, ensuring that all tax filings are done ahead of time, and they are always available for guidance."

Proactive and Reliable

Proactive and Reliable"With their international expertise and deep knowledge of the Dutch tax system, our business has flourished in the Netherlands. We highly recommend their services to any company expanding into Europe."

A Trusted Partner

A Trusted Partner

We begin by assessing your business model and developing a tailored tax plan. This helps identify areas for tax savings and ensures you are fully compliant with Dutch tax laws.

We offer full support to guarantee that your company continues to comply with tax regulations, ranging from bookkeeping to filings at the end of the year. Collaboration between our tax consultants and accountants helps to ensure accuracy and reduce the likelihood of potential risks.

Our team continuously monitors your business to ensure that all necessary tax filings and VAT declarations are submitted on time. We keep you updated with

changes in tax laws and regulations, allowing you to focus on your operations.

Answers to common queries regarding corporate tax and VAT regulations.

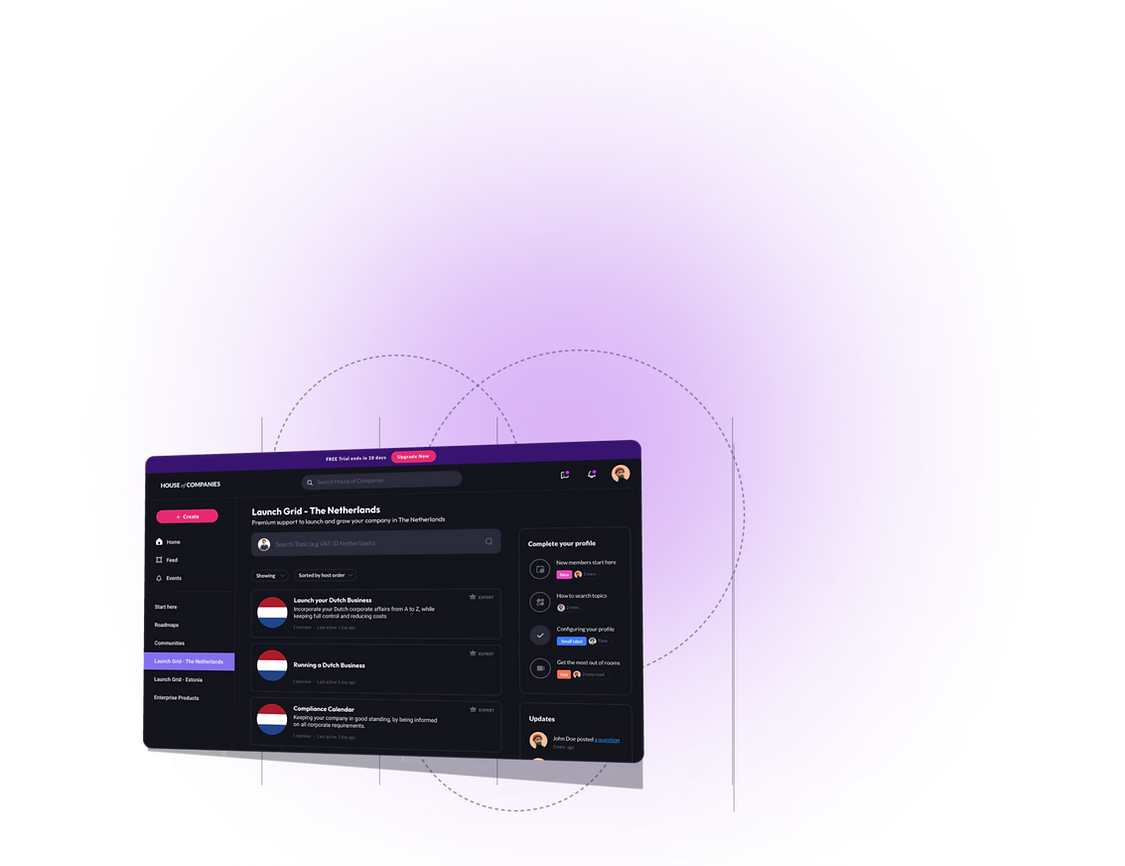

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!