Registering your company with the KVK is a key step in starting a business in the Netherlands. This process ensures that your business is legally recognized and that you comply with Dutch laws and regulations. Before you begin, it's important to decide on your business structure (e.g., sole proprietorship, partnership, or limited liability company) as this will affect your registration process and obligations.

Choose a Business Structure: Decide on the legal form of your company (e.g., sole proprietorship, BV, VOF, etc.) based on your needs and circumstances.

Prepare Required Documents: Gather necessary documents such as a valid form of identification (passport or ID card), proof of address, and any additional documents relevant to your business type (like partnership agreements).

Select a Business Name: Choose a unique name for your company that complies with Dutch naming regulations. You can check the KVK’s database to ensure your name is not already in use.

Complete the KVK Registration Form: Download and fill out the registration form available on the KVK website. Ensure all information is accurate and complete.

Schedule an Appointment: Book an appointment at your local KVK office. This can usually be done online through the KVK website.

Attend the Appointment: Go to the KVK office on your scheduled date. Bring your completed registration form and all required documents.

Provide Business Information: During your appointment, you will provide details about your business activities, address, and personal details. Ensure you have all necessary information ready.

Pay the Registration Fee: You will be required to pay a registration fee (the amount varies depending on the business type). Payment can often be made on-site at the KVK office.

Receive Your KVK Number: After successful registration, you will receive a unique KVK number. This number is crucial for legal and tax purposes.

Register for Taxes: Finally, register your business with the Dutch Tax and Customs Administration (Belastingdienst) to fulfill your tax obligations. You can often do this during your KVK appointment or separately online.

By following these steps, you can successfully register your company with the KVK, ensuring compliance with Dutch business regulations and paving the way for your entrepreneurial journey in the Netherlands.

A Dutch Besloten Vennootschap (BV), or private limited company, requires a minimum share capital to ensure its financial stability and credibility. As of 2012, the Netherlands has removed the previous minimum share capital requirement of €18,000, allowing entrepreneurs greater flexibility when establishing their BV. Currently, the only requirement is that the share capital must be at least €0.01. This significant reduction has made it easier for startups and small businesses to register and operate without the burden of a high initial financial commitment.

Although the minimum share capital is only €0.01, it is essential to note that the amount of share capital should realistically reflect the company’s needs. A well-capitalized business is more likely to gain the trust of suppliers, banks, and investors, enhancing its operational capabilities and growth potential. While a nominal capital of €0.01 allows for easy registration, many companies choose to set their share capital at a higher amount to signal stability and commitment to potential partners and customers.

Setting a higher share capital than the minimum required can provide several advantages for a Dutch BV. Firstly, it can improve the company's creditworthiness. Financial institutions often assess the share capital when determining the risk of lending to a business. A higher share capital can lead to better financing options, allowing the company to secure loans or attract investors more easily.

Secondly, a higher share capital can enhance the company’s image in the eyes of customers and suppliers. When a company is perceived as financially stable, it builds trust and confidence, which can lead to better business relationships. Clients may prefer to work with companies that demonstrate a solid financial foundation, reducing perceived risks associated with transactions.

Moreover, having a higher share capital can also facilitate future growth and expansion. Businesses that plan to engage in significant investments, such as acquiring assets or hiring employees, may find that a stronger financial position gives them more flexibility in their operations.

While the minimum share capital requirement for a Dutch BV is merely €0.01, setting a higher amount can provide significant strategic advantages in terms of creditworthiness, market perception, and operational flexibility. Entrepreneurs should carefully consider their long-term business objectives when determining the appropriate share capital for their BV.

A Dutch Besloten Vennootschap (BV) has several tax obligations that must be met to comply with Dutch tax law. One of the primary taxes applicable to a BV is the corporate income tax (CIT). A BV is subject to CIT on its worldwide income, which includes profits generated both within and outside the Netherlands. The current CIT rates are 15% for profits up to €200,000 and 25.8% for profits exceeding that threshold. This progressive rate structure encourages smaller businesses while imposing higher rates on larger profits.

In addition to corporate income tax, a BV is required to file an annual tax return with the Dutch Tax and Customs Administration. This return must include financial statements, a profit and loss account, and additional documentation supporting the reported income and expenses. It is crucial to ensure accurate reporting, as discrepancies may lead to audits and potential penalties.

Value-added tax (VAT) is another significant tax obligation for a BV. If the BV engages in commercial activities, it must charge VAT on goods and services sold. The standard VAT rate in the Netherlands is 21%, while a reduced rate of 9% applies to certain goods and services. The BV must regularly submit VAT returns, usually quarterly or annually, to report collected and paid VAT.

Furthermore, if the BV employs staff, it has payroll tax obligations. This includes withholding income tax and social security contributions from employee salaries. The BV is responsible for remitting these amounts to the tax authorities on a monthly basis.

A BV must also consider dividend tax when distributing profits to shareholders. The standard dividend tax rate is 15%, which applies to dividends paid out of the after-tax profits of the BV. Proper documentation and filing are necessary to comply with these regulations and avoid double taxation.

Finally, maintaining proper accounting records is vital for a BV to meet its tax obligations. Accurate bookkeeping ensures compliance with tax laws and provides a clear financial picture for tax assessments. Regular audits may be necessary to verify that the BV adheres to tax regulations and accurately reports its financial status.

Operating a company in the Netherlands, particularly a Dutch Besloten Vennootschap (BV), involves adhering to several ongoing compliance requirements to ensure legal and operational integrity. These requirements encompass financial reporting, tax obligations, and corporate governance, which are crucial for maintaining good standing with regulatory authorities. Compliance not only fosters trust with stakeholders but also protects the company's interests in a competitive business environment.

Dutch companies are required to prepare annual financial statements that provide a comprehensive overview of their financial position and performance. These statements must comply with Dutch Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the company’s size and nature of operations. Companies are classified into micro, small, medium, and large categories, each with specific reporting obligations.

For micro and small companies, the requirements are less stringent, often allowing for simplified financial statements. However, medium and large companies must prepare full financial statements and have them audited by a registered auditor if they exceed certain thresholds, such as revenue and total assets. Additionally, companies must file their financial statements with the Dutch Chamber of Commerce (Kamer van Koophandel or KvK) within 8 days of their approval by the shareholders.

Tax compliance is another critical aspect of ongoing obligations for Dutch companies. Companies must file corporate income tax returns annually, typically due within five months after the end of the fiscal year. In some cases, companies may request an extension for filing. It’s important to ensure accurate reporting of profits and compliance with transfer pricing regulations to avoid potential penalties.

Moreover, Dutch companies are required to maintain accurate and up-to-date records of their shareholders, directors, and any changes in corporate structure. They must also hold annual general meetings (AGMs) to discuss financial results, dividends, and other significant decisions impacting the company. Proper corporate governance practices, including transparency and accountability, are essential not only for compliance but also for building stakeholder confidence.

In addition, companies must comply with the Dutch Anti-Money Laundering (AML) regulations, which require them to have procedures in place for identifying and reporting suspicious activities. Failure to adhere to these ongoing compliance requirements can lead to significant legal repercussions, including fines and damage to the company's reputation. Thus, it is crucial for Dutch companies to establish robust compliance frameworks to manage these obligations effectively.

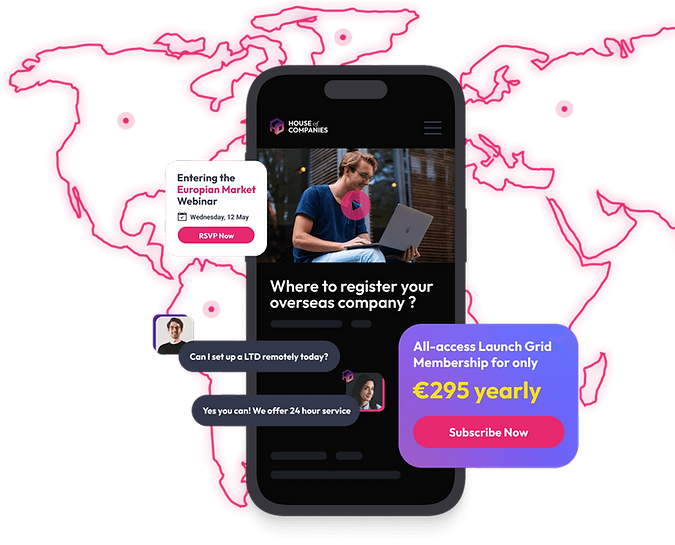

With a combined twelve years of expertise, the House of Companies team has been helping Dutch entrepreneurs launch their businesses.

Did you know that a branch may be registered in as little as one day?

Can you tell me if a notary is needed to register a branch or not?

Anyone starting a business in the Netherlands using our Entity Portal may be certain that they will be able to create an IBAN payment account.

Forming a local company, such a BV, is losing ground to registering a branch in the Netherlands. One of the pioneers in enabling this empowerment for entrepreneurs throughout the world is House of Companies. House of Companies can help you establish your Dutch firm with less reliance on costly advisors and notaries.

How about we discuss your choices?

Of course! A good thing about the Netherlands is that you don't have to live there to start a business there. Yes, you can definitely start a business in Holland as long as you have a real address there and can meet all the legal requirements. As part of this, you need to have a formal agent in the country and register your business with the Dutch Chamber of Commerce.

At first, the steps may seem hard, but with the right help and direction, you'll be able to get your business up and running in no time. Entrepreneurs from all over the world want to move to Holland because it has a strong economy, is in a good location, and is friendly to business.

But don't let the fact that you're not a local stop you—use the chances that are there and make your business dreams come true in the Netherlands!

How about we discuss your choices?

An efficient alternative to forming a full-fledged Dutch corporation is to set up a representative office to represent your interests in the country.

When doing business in the Netherlands, a representative office might act as an intermediary between your present firm and prospective partners or customers.

It opens doors to networking, market research, and potential business prospects. Even though a representative office can't make money, it's a safe way to get into the Dutch market.

Once your representative office is prepared to start making money, we may transform it into a full-fledged branch. This will grant it the authority to register for VAT, become an Employer of Record, and do much more besides.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!